How2invest: A Comprehensive Guide to Successful Investing

In today’s fast-paced world, investing has become an essential aspect of financial planning. Whether you are a seasoned investor or just starting your investment journey, understanding how to invest wisely is crucial for achieving your financial goals. This article aims to provide you with a comprehensive guide on how to invest effectively, covering various aspects of investment strategies, risk management, and key considerations. By the end of this article, you will have a solid foundation to make informed investment decisions and enhance your financial well-being.

How to Invest: A Comprehensive Guide to Successful Investing

Investing is the process of allocating money or resources to different assets with the expectation of generating profits over time. It provides individuals with the opportunity to grow their wealth and achieve financial independence. However, investing can be complex and intimidating for beginners. This guide will walk you through the key principles and strategies to become a successful investor.

What is Investing?

Investing involves purchasing assets such as stocks, bonds, or real estate with the expectation of generating income or profit from the appreciation of their value over time. By investing wisely, you can make your money work for you and create wealth.

Importance of Investing

Investing is crucial for several reasons. It helps beat inflation, build wealth, fund retirement, and achieve financial goals such as buying a house or starting a business. By investing early and consistently, you can take advantage of compounding returns and maximize your long-term financial growth.

Setting Financial Goals

Before you start investing, it’s essential to define your financial goals. Whether it’s saving for retirement, buying a car, or funding your child’s education, having clear objectives will guide your investment decisions and help you stay focused.

Types of Investments

There are various investment options available to suit different risk appetites and financial objectives. Understanding these options can help you build a diversified investment portfolio. Some common investment types include:

Stocks

Stocks represent shares of ownership in a company. When you invest in stocks, you become a shareholder and have the potential to earn returns through capital appreciation and dividends.

Bonds

Bonds are debt instruments issued by governments, municipalities, or corporations to raise capital. When you invest in bonds, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers, making them a convenient option for investors seeking diversification and professional expertise.

Real Estate

Investing in real estate involves purchasing properties, such as residential or commercial buildings, with the goal of generating rental income or capital appreciation. Real estate can provide a steady income stream and serve as a tangible asset in your investment portfolio.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and can track specific market indexes or sectors. ETFs provide flexibility and liquidity for investors.

Commodities

Commodities include tangible goods like gold, oil, natural gas, or agricultural products. Investing in commodities can act as a hedge against inflation and diversify your investment portfolio.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They have gained popularity in recent years but come with higher volatility and risk. Investing in cryptocurrencies requires careful research and risk assessment.

Building an Investment Portfolio

To achieve a balanced and diversified investment portfolio, consider the following factors:

Asset Allocation

Asset allocation refers to the distribution of your investments across different asset classes, such as stocks, bonds, and real estate. The right asset allocation strategy depends on your risk tolerance, financial goals, and time horizon.

Diversification

Diversification involves spreading your investments across different assets, sectors, or geographical regions. By diversifying, you reduce the risk of significant losses from any single investment.

Risk Tolerance

Understanding your risk tolerance is crucial for determining the proportion of your portfolio allocated to higher-risk investments like stocks. Assessing your risk tolerance helps you strike a balance between risk and potential returns.

Time Horizon

Your time horizon refers to the duration for which you plan to invest your money. Longer time horizons allow you to take advantage of compounding returns and tolerate short-term market fluctuations.

Investment Strategies

Different investment strategies, such as value investing or growth investing, can guide your investment decisions. Research various strategies and choose the one that aligns with your financial goals and risk appetite.

Conducting Research

Thorough research is essential before making any investment decisions. Consider the following types of analysis:

Fundamental Analysis

Fundamental analysis involves analyzing a company’s financial health, earnings potential, and competitiveposition. It includes examining financial statements, evaluating management, and assessing industry trends to determine the intrinsic value of a stock or investment.

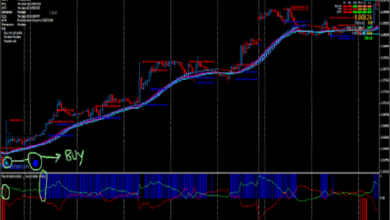

Technical Analysis

Technical analysis involves studying price charts, patterns, and market indicators to predict future price movements. It helps identify trends, support and resistance levels, and potential entry or exit points for investments.

Economic and Market Analysis

Economic and market analysis involves monitoring macroeconomic indicators, such as GDP growth, interest rates, and inflation, to understand their impact on the overall market. It helps investors make informed decisions based on the current economic climate.

Company Analysis

Analyzing individual companies involves assessing their financial stability, competitive advantage, and growth potential. Factors such as revenue growth, profit margins, and market share can provide insights into a company’s long-term prospects.

Risk Management

Understanding and managing risk is crucial for successful investing. Consider the following risk management strategies:

Understanding Risk

Recognize that all investments carry some level of risk. By understanding the risks associated with each investment, you can make informed decisions and manage your portfolio effectively.

Risk vs. Reward

Evaluate the potential return against the level of risk involved. Higher-risk investments may offer greater returns, but they also carry a higher chance of losses. Determine your risk appetite and invest accordingly.

Asset Class Risks

Different asset classes carry unique risks. For example, stocks are subject to market volatility, while bonds face interest rate and credit risk. Understand the risks associated with each asset class before investing.

Risk Mitigation Strategies

Diversification, setting stop-loss orders, and implementing trailing stops are some risk mitigation strategies. These measures help protect your portfolio from significant losses and reduce exposure to individual investments.

Tax Considerations

Understanding tax implications can optimize your investment returns. Consider the following tax considerations:

Tax-Advantaged Accounts

Utilize tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k)s. Contributions to these accounts may be tax-deductible, and investment gains can grow tax-deferred or tax-free until withdrawal.

Tax-Efficient Investing

Invest in tax-efficient investment vehicles that generate minimal taxable income, such as index funds or ETFs. These investments can help reduce your tax liability, especially in taxable brokerage accounts.

Capital Gains Tax

Understand the tax implications of selling investments for a profit. Short-term capital gains are typically taxed at higher rates than long-term capital gains. Consider holding investments for longer periods to benefit from lower tax rates.

9. Long-Term Investing

Long-term investing aims to generate wealth over an extended period, typically more than five years. Consider the following strategies:

Compound Interest

Harness the power of compounding by reinvesting your investment returns. Over time, compounding allows your initial investment to grow exponentially, as both the principal amount and accumulated returns generate further gains.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount at regular intervals, regardless of market conditions. By investing consistently over time, you buy more shares when prices are low and fewer shares when prices are high, potentially lowering your average cost per share.

Buy and Hold Strategy

The buy and hold strategy involves investing in high-quality assets for the long term, regardless of short-term market fluctuations. It requires patience and discipline, with a focus on the long-term growth potential of your investments.

Short-Term Investing

Short-term investing involves buying and selling securities within a short time frame, typically less than a year. Consider the following short-term investment strategies:

Day Trading

Day trading involves buying and selling securities within the same trading day to capitalize on short-term price movements. It requires active monitoring of the market and significant time commitment.

Swing Trading

Swing trading aims to capture short-term price movements over a few days to weeks. Traders analyze technical indicators and chart patterns to identify entry and exit points for their trades.

Momentum Trading

Momentum trading focuses on securities that show significant upward or downward price momentum. Traders aim to profit from the continuation of the prevailing trend and typically hold positions for a few days to weeks.

Investing in a Volatile Market

Volatility is an inherent characteristic of the stock market. Consider the following strategies to navigate a volatile market:

Emotional Discipline

Maintain emotional discipline and avoid making impulsive investment decisions based on short-term market fluctuations. Focus on your long-term investment goals and stick to your investment plan.

Contrarian Investing

Contrarian investing involves taking positions opposite to prevailing market sentiment. Buying when others are selling or selling when others are buying can provide opportunities to capitalize on market inefficiencies.

Dollar-Cost Averaging

In a volatile market, dollar-cost averaging can help mitigate the impact of short-term price fluctuations. By investing a fixed amount regularly, you buy more shares when prices are low, potentially benefiting from market downturns.

Evaluating Investment Performance

Regularly assessing the performance of your investments is essential. Consider the following metrics:

Return on Investment (ROI)

ROI measures the profitability of an investment. It is calculated by dividing the gain or loss from an investment by the initial investment amount, expressed as a percentage.

Risk-Adjusted Return

Risk-adjusted return measures the return of an investment relative to its level of risk. It helps evaluate how well an investment performs considering the amount of risk taken.

Benchmarking

Compare the performance of your investments against relevant benchmarks, such as market indexes or peer groups. Benchmarking provides a benchmark for evaluating your investment’s relative performance.

Seeking Professional Advice

Consider seeking professional advice from financial advisors, robo-advisors, or investment newsletters. These resources can provide expert guidance tailored to your financial goals and risk tolerance.

Common Investment Mistakes to Avoid

Avoid these common investment mistakes:

Emotional Investing

Making investment decisions based on fear or greed can lead to poor outcomes. Emotionally-driven decisions may result in buying high and selling low, derailing your long-term investment strategy.

Chasing Trends

Avoid chasing hot investment trends or fads without conducting thorough research. Investments should be based on sound analysis and align with your financial goals, rather than short-term market hype.

Lack of Diversification

Failing to diversify your investment portfolio increases your exposure to risk. Spread your investments across different asset classes and sectors to reduce the impact of any single investment’s poor performance.

Timing the Market

Attempting to time the market by predicting short-term price movements is challenging and often counterproductive. Focus on long-term investment strategies rather than trying to predict short-term market fluctuations.

Conclusion

How2invest is a powerful tool for achieving financial success and building wealth. By following the principles and strategies outlined in this guide, you can navigate the world of investing with confidence. Remember to set clear financial goals, conduct thorough research, manage risk effectively, and stay disciplined in your investment approach. With time, patience, and a commitment to continuous learning.